The matter of stamp duty continues to be a sensitive subject ….and not just for the wealthy as the effect of this punitive tax is felt well beyond this sector.

The December statement in 2014 announced a different system where the wealthy were charged more stamp duty and the method of charging was reformed. The Exchequer hoped that this would be fairer and that it would also generate more tax receipts but on the latter, the opposite has actually been the case. Transaction levels have fallen significantly and accordingly tax receipts. In addition associated industries such as builders, decorators and furniture and kitchen manufacturers have seen their order books contract. The Exchequer sites other market forces for these weak statistics on stamp duty receipts such as Brexit and, at the top end of the market, the collapse of the Russian rouble!

Further reform in April last year saw a surcharge of 3% applied to those buying investment property. Significant activity and acquisitions were undertaken up to the date when this surcharge was to become effective and then, as is so often the case, a significant falling off thereafter.

From our perspective, a less onerous tax liability for purchases over £937,500, the point at which stamp becomes more expensive than prior to 2014, would be welcome as it is clearly having a damaging effect on the market in this sector. However we would like to see the government continue to encourage first time buyers with their schemes such as Help To Buy perhaps better funded because stamp duty receipts will improve because of this softening of the stamp duty charges and therefore more properties transacting. For buy to let investors, they’re being hit from all sides and so the government will need to be careful that they do not dissuade landlords as renting is the only option for many young people setting out on their careers never mind others who need to have a flexible lifestyle.

2017 will be seen as momentous for many years to come as a new world order prevails. Article 50, to instigate our withdrawal from the EU, will be served at the end of March and Trump’s presidency has now begun. Much has been written about the implications of Brexit for the UK but one thing must surely be imperative….that we make the very most of these circumstances. To be woeful may be counterproductive whereas confidence and optimism will surely take us further in all the negotiations that lay ahead of us.

So, back to the world of property. We have seen no adverse affects on demand following last year’s key economic influences and yet the low volume market that has existed for quite some years now, remains. There are many reasons for this but the take-away from this imbalance is that firstly sale prices remain strong and secondly there is no reason to delay the sale of your property believing that buyers are staying away….they’re not and particularly because mortgage rates remain so inexpensive. Mortgage rates this low won’t continue forever and so one could conclude that buyer demand is acutely strong now where it may not be if mortgage rates tick up from say 1.5% to 2%…still historically low but a significant % increase and a drag on household resources.

We had an exceptionally strong finish to 2016 agreeing 3 sales on Christmas Eve and then started 2017 with 2 further sales in the first week back at the office. We are about to agree another as I write ….and all within 98% of the guide price we had advised demonstrating good accuracy with our assessments. Indeed most of these sales had multiple offers. A trickle of new houses are coming to market. Some are being offered ‘off market’ and so if you are a buyer, do get in touch to hear about those that aren’t openly visible in the market …and if you are seller, you needn’t necessarily ‘blow your powder’ by going open market immediately…we can ‘litmus test’ the market first, achieve some market intelligence (but hopefully a strong buyer!) and then set our open market guide price based on this. To over shoot the guide price is to often sell for less than the property’s true ‘value’ and so this launch price is critical to the success of your campaign.

We would be really pleased to hear from you if a sale is remotely in your mind, with no obligation, but before doing so please do watch our videos where you can see and hear about our ethos and approach.

Patrick Glynn Jones

Changes have now been introduced in the way in which landlords can claim tax relief on the cost of their finance.

Following is some guidance as to the way in which changes to tax relief may affect you as a landlord. Please note that we are giving this information as an experienced Lettings Agent and not accountants, therefore for any tax advice please refer to your accountants.

The changes apply to the following expenses:

- The costs relating to finance (ie. interest on mortgages, overdrafts and loans (including loans to buy furniture, etc.)

- Fees (loan arrangement, early repayment, etc.)

The changes apply to the following:

- Individuals – both UK resident and non UK resident – who let out residential property – either in the UK or overseas.

- Individuals in partnerships who let out property as above.

- Trustees or the beneficiaries of trusts who are liable for income tax on the property profits.

The changes do not apply to:

- Companies

- Furnished Holiday Lettings

- Commercial Property

The Current Situation

An individual can offset the costs of their finance (on property which they rent out) along with all their other allowable costs against their total Income (both renting and from other sources) and pay income tax on the balance at whatever tax threshold applies to their net income.

Changes

From the tax year beginning April 2017 changes will be introduced over a four year period so that a growing proportion of finance costs will not be able to be claimed as a cost but INSTEAD there will be an additional basic rate tax allowance

Year 2017/18 75% deducted in the current way & 25% basic rate allowance

Year 2018/19 50% deducted in the current way & 50% basic rate allowance

Year 2019/20 25% deducted in the current way & 75% basic rate allowance

Year 2020/21 0% deducted in the current way & 100% basic rate allowance

Additional Allowance

The basic rate tax allowance is applied to whichever is lower

- The finance costs that are not deducted in the current way

- The property profits (ie income less allowable finance and other costs)

- The adjusted total income (over and above the Personal allowance). This is the total taxable income (less PA)

If the finance costs are not the lowest of these three then any unused finance costs (ie. the difference between finance costs and the figure used for calculation) can be carried forward to the following year.

The Effect of the Changes

The effects of this can be varied. It is likely that most people will have to pay more tax. It is also quite possible that some landlords who are just below the threshold for the higher rate of tax might be pushed over that threshold. However some taxpayers may remain unaffected.

Wear and Tear Allowance

The wear and tear allowance for landlords of furnished property has now been abolished and has been replaced by a straightforward replacement allowance. A landlord can now claim for the capital expenditure on furniture, furnishings, appliances (inc. white goods) and kitchenware as long as they are replacement items for use in the rented establishment.

The claim can be for:

- the cost of the item (limited to the cost of an equivalent item and not an improvement)

- the cost of disposal of the old item less any income from that disposal

Please note that we are giving this information as an experienced Lettings Agent and not accountants, therefore for any tax advice please refer to your accountants.

If you would like to discuss any of the above please contact us on marishelle@countryhousecompany.co.uk or call 02392 632275

One of the many benefits of working in an open plan office is that you hear the comments of others and more often than not in this office the whoops of delight as another house is let or sold. The most recent exclamation was from Emilie when a check on our Righmove statistic showed a massive spike in views to the details of our properties since the 21st January. Although delighted by the sudden considerable increase in views, we are not surprised that there is so much activity. 2016 finished on a high note for the lettings team with more lets agreed and more requests for appraisals than for the same period in 2015. Applicant registrations for December and January were up and we have 33% more ‘check ins’ booked for January than last year.

We are constantly watching the market and monitoring the general trends and influences on the lettings market such as Brexit, tax changes and possible legislation on tenant fees. Whilst these will undoubtedly affect the general market, here in Hampshire and West Sussex we are thrilled with the start to our year.

For more details on this please see our January newsletter

Marishelle Butler

The Country House Company has been appointed to sell this 4 bedroom, 3 bathroom, village house with a double garage, additional off street parking and a charming south facing garden. The house is in East Meon, a highly popular Meon Valley village. The guide price is £775,000.

The Country House Company has been appointed to sell this 4 bedroom, 3 bathroom, village house with a double garage, additional off street parking and a charming south facing garden. The house is in East Meon, a highly popular Meon Valley village. The guide price is £775,000.

The Green has a classical design influence, and 4 is well positioned in this private residential close on the south western edge of East Meon. The property enjoys a southerly rear aspect with a sheltered garden behind and to one side. The house has a flexible internal layout with a spacious hall, off which lead the main reception room, dining room, study and kitchen/breakfast room. There is also a useful, separate utility room.

Upstairs there are four double bedrooms two with en suite bath/shower rooms and a family bathroom all contributing to well balanced accommodation.

The garden has a paved terrace and other useful paved areas to catch as much afternoon sunshine as possible. A lovely hornbeam tree provides natural shade and an attractive focal point. The garden is mostly lawn with several well stocked borders and plenty of mature shrubs. The outer drive provides useful additional parking and sweeps up to the generous double garage.

Planning permission has been achieved for a modest single storey extension which expands the size of the study and allows it to interact more strongly with the garden. The plans can be viewed on the SDNPA website under reference SDNP/16/03901/HOUS.

For a viewing please call Patrick on 02392 632275.

Hampshire Fare began this year with an enthusiastic gathering at The White Star Tavern in Southampton for members and sponsors on Tuesday 10th January 2017.

Hampshire Fare began this year with an enthusiastic gathering at The White Star Tavern in Southampton for members and sponsors on Tuesday 10th January 2017.

The local not-for-profit food group, established in 1991, supports Hampshire food producers with marketing, PR, training, routes to market and event opportunities. Around forty members and sponsors of the dynamic organisation gathered this week to talk 2017 plans.

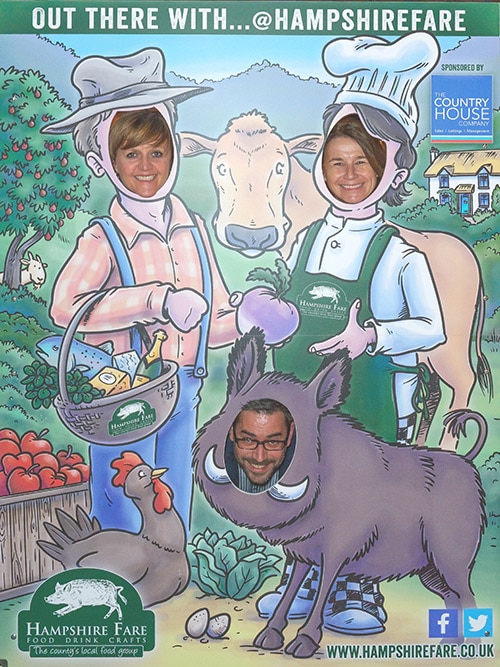

Hampshire Fare took the opportunity to reveal a preview of the new Local Produce Guide which will be available across the county from February. Guests were also invited to road test the food group’s new photo board. Sponsored by The Country House Company the board depicts a country scene drawn by local artist Simon Chadwick. Hampshire Fare and The Country House Company collaborated on the project to help engage the public and to highlight the people behind Hampshire’s produce.

The board proved a big hit at the networking event. The plan is to take the board to events in and out of the county and to get as many people as possible showing their smiles in support of the local food scene.

Visit Hampshirefare.co.uk to find out more about where you can buy and try local food and drink.

Time passes all too quickly, particularly at this time of the year, and unbelievably it has already been a week since the autumn statement and all the turmoil it caused for letting agents. The announcement that caused the huge reaction in the printed, broadcast and social media was simply a single sentence saying the government would ban tenant fees for letting agents. There was no further detail and therefore we are left not knowing the extent of the ban or the time scale.

Much of the focus of the media had been on the apparently inevitable, knock on effect. The assumption being, that letting agents will need to pass the fees to landlords who in turn will put up rent to cover their increased costs.

Here at The Country House Company we are confident our fees are fair and transparent. We will continue with the same fee structure until we are instructed otherwise and if there is going to be a reallocation of fees we will give plenty of warning.

The initial expectation from ARLA was that the ban on tenant fees would take 12 – 18 months to implement. ARLA have issued an update today stating:

“This expectation has been confirmed by DCLG (Department for Committees and Local Government) although there is no guarantee that legislation will not be added to an existing bill which would bring the timetable forward.”

Although ARLA go on to say that “Agents have to start to make practical preparations now”, here at The Country House Company we are going to keep calm, keep you informed and carry on…………..

Marishelle Butler

After my family’s visit to The Christmas Market and ice skating at Winchester Cathedral on Sunday, we returned home to read a piece in The Sunday Times that referred to the significance of a Christmas Market to an area. Of those cities that have Christmas markets, Winchester featured third in terms of price growth over the last 5 years… 42%. We are very fortunate to have such a wonderful city in our midst, particularly at Christmas…and well worth a visit!

Interestingly another article talked about the exchange rate effects for international property buyers in the UK and how there has been a discernible sea change in buyer profile to reflect this. This became pertinent for us this morning when a family called wanting a valuable home as they are moving here from the UAE. Our education system was a key driver for them but it can’t be ignored that their timing is spot on as the £ to Dirham exchange has improved significantly over the last year making a home in the UK almost 20% less expensive in real terms.

Patrick Glynn Jones

ARLA The Association of Residential Lettings Agents has announced that ban on letting agents charging tenant fees is a ‘crowd-pleaser that will not help renters in the long term.’ ARLA have campaigned for a coherent, mandatory regulation of the sector and a fair deal to cover the significant work that agents do for tenants. In their statement released this morning they go on to explain;

‘A ban on letting agent fees is a draconian measure, and will have a profoundly negative impact on the rental market. It will be the fourth assault on the sector in just over a year, and do little to help cash-poor renters save enough to get on the housing ladder. This decision is a crowd-pleaser, which will not help renters in the long-term. All of the implications need to be taken into account.’

The Chancellor is just about to speak; we will be listening with interest………….

Marishelle Butler